Market Survey: Commercial Roofing Market

Western Low-Slope Roofing Market Continues Its Upward Trend

by Marc Dodson, editor

With the construction industry growing steadily nationwide, the Western half of the United States seems to be leading the pack. This is excellent news for Western roofing contractors, as 2018 will close out as another banner year for the low-slope market. Naturally, while it may depend on your market as to just how big of an increase you’ll see, almost every roofing contractor involved with commercial roofing in the West should see improvement. Both the low-slope and steep-slope markets are up this year.

As the stock market continues to rise, investing in future enterprises will increase and the subsequent expansion of plant size and warehouse space will continue. All of this means more money directed toward new construction, as well as repairs to existing facilities. As a result, Western roofing contractors are reaping the benefits.

Commercial roofing contractors never really encountered the deep recession that was experienced by their residential counterparts a few years ago, but it was still an uphill climb. The Western commercial roofing market began picking up steam several years ago and has continued to increase steadily ever since.

With very few exceptions, the low-slope roofing contractors we contacted, as well as several manufacturers, shared the opinion that the final totals for the 2018 Western commercial market would be a record year. Additionally, figures compiled from our own survey, plus information derived from several industry sources, indicate commercial and industrial roofing construction in the Western half of the United States will continue to increase.

As in the past, the low-slope roofing market will account for the major share of the total Western roofing market this year, with 57% of the total volume. While the dollar volume as well as the number of squares applied is up, the percentage is down from 59% last year. This is due to the meteoric rise in the steep-slope market over the previous year.

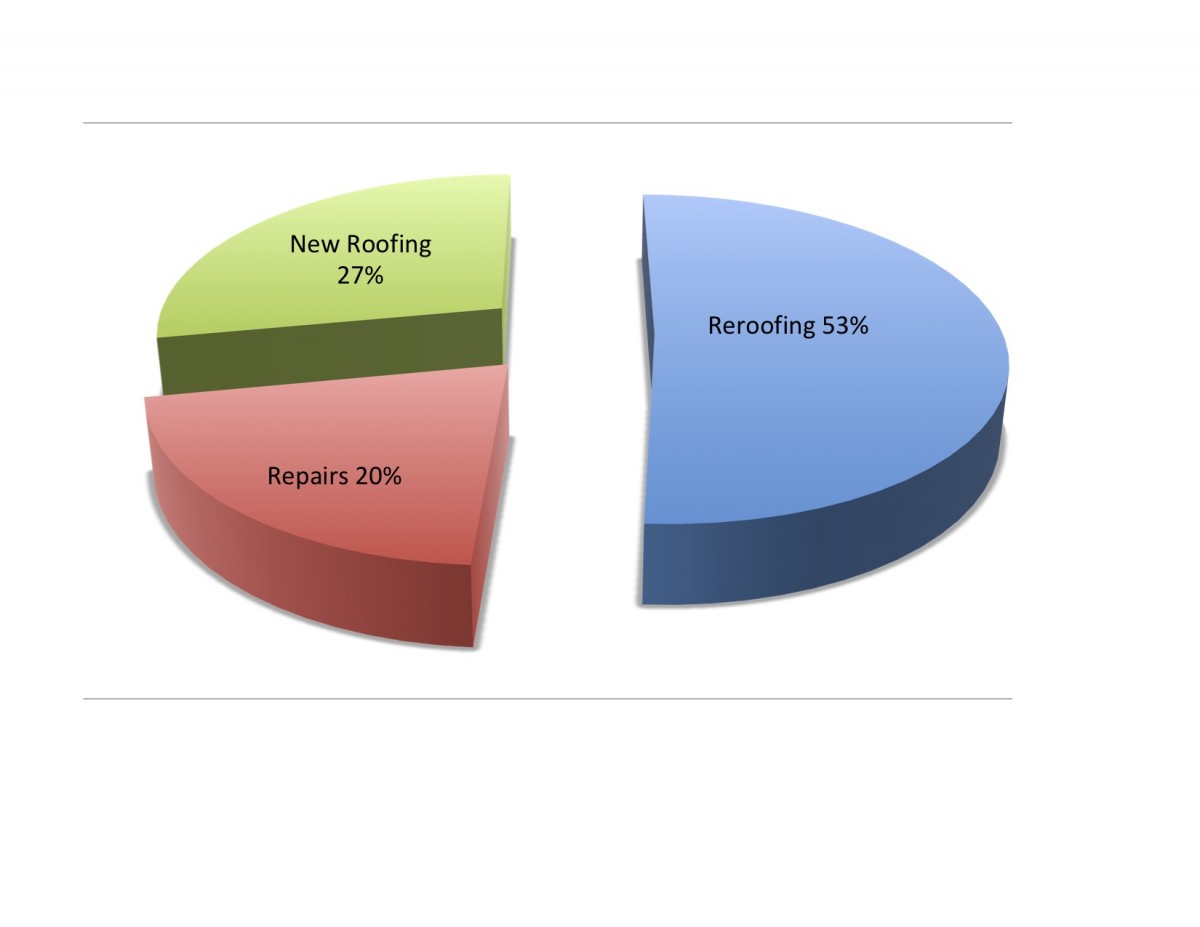

As always, reroofing dominates the Western low-slope roofing market, taking a predicted 51%. Again, the dollars are up but the percentage is down as more new roofs are being applied. Repairs and maintenance account for 21%, with new construction picking up the remaining 28%.

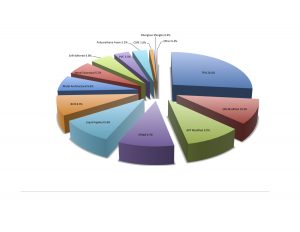

As far as the popularity of commercial roofing products, we saw some changes again this year. All modifieds, such as SBS, APP, and self-adhered, now account for 25% of the low-slope roofing market. All forms of single-ply, like TPO, EPDM, PVC, and CPE, have a combined share of 40.8% and are the number one material in the commercial roofing market in the West again this year. This is up substantially from the 37.4% last year.

Among single-ply options, TPO showed the biggest gains by once again claiming the number one spot with a 26.6% market share. EPDM takes the number two spot with 9.7%, also up very slightly from last year.

As single-ply options increase, BUR continues its decline. It comes in this year with 8.3%, dropping from 12.3% last year. Liquid-applied products gain very slightly to 9.6%. Metal roofing products, both architectural and structural, also saw a rise in their market shares over the past year.

Of course nobody knows what will happen next year, but from all economic indicators, it looks like the national construction economy will continue to increase as businesses expand. Building and facility owners will be spending money as the economy grows. The steady increase we saw over the last several years will hopefully continue, and it looks like the Western low-slope market will continue to lead the charge.