Market Survey: Steep-Slope Market

Western Residential Roofing Market Looks Very Healthy Indeed

by Marc Dodson, editor

Despite dire predictions of a recession, the Western steep-slope market seems to be defying all odds. While the rate of increase has slowed, the steep-slope market in the West is still quite healthy. Any increase is good, so we’ll take it. In the last several years, many made the switch from commuting to working remotely. In the process, remodeling, larger homes, and the office-vacation homes became the norm. Despite numerous companies trying to lure employees back to their main office, employees like this new way of working from home and are resisting. In numerous instances, corporate office space is permanently being downsized. Many companies have come to realize that having employees work remotely is a viable long-term option. It’s something nobody would have predicted a few years ago, but the pandemic-induced home office is no longer temporary, but here to stay.

Reports from contractors throughout the West show a continued improvement in new residential roofing. Steep-slope reroofing also continues to rise and new residential construction projects around the West are being built. With a few exceptions, we’re pretty much hearing the same report all around the West. New residential construction projects and reroofing projects are definitely still on the rise.

Supply & Demand

While the actual amount of residential roofing materials sold has slowed, their availability has increased. We’re being told that the wait for material to arrive for a job has been reduced from several months to a matter of weeks. As an added bonus, the Associated General Contractors has reported that finished and raw construction material prices have started to fall across the board. The law of supply and demand kicks in once again, this time in the roofing contractor’s favor.

This year, the Western steep-slope market will likely account for 49% of the roofing pie, which is about the same as last year. According to a number of sources, including industry experts, construction industry associations, financial institutions, and our own surveys, this trend will likely continue.

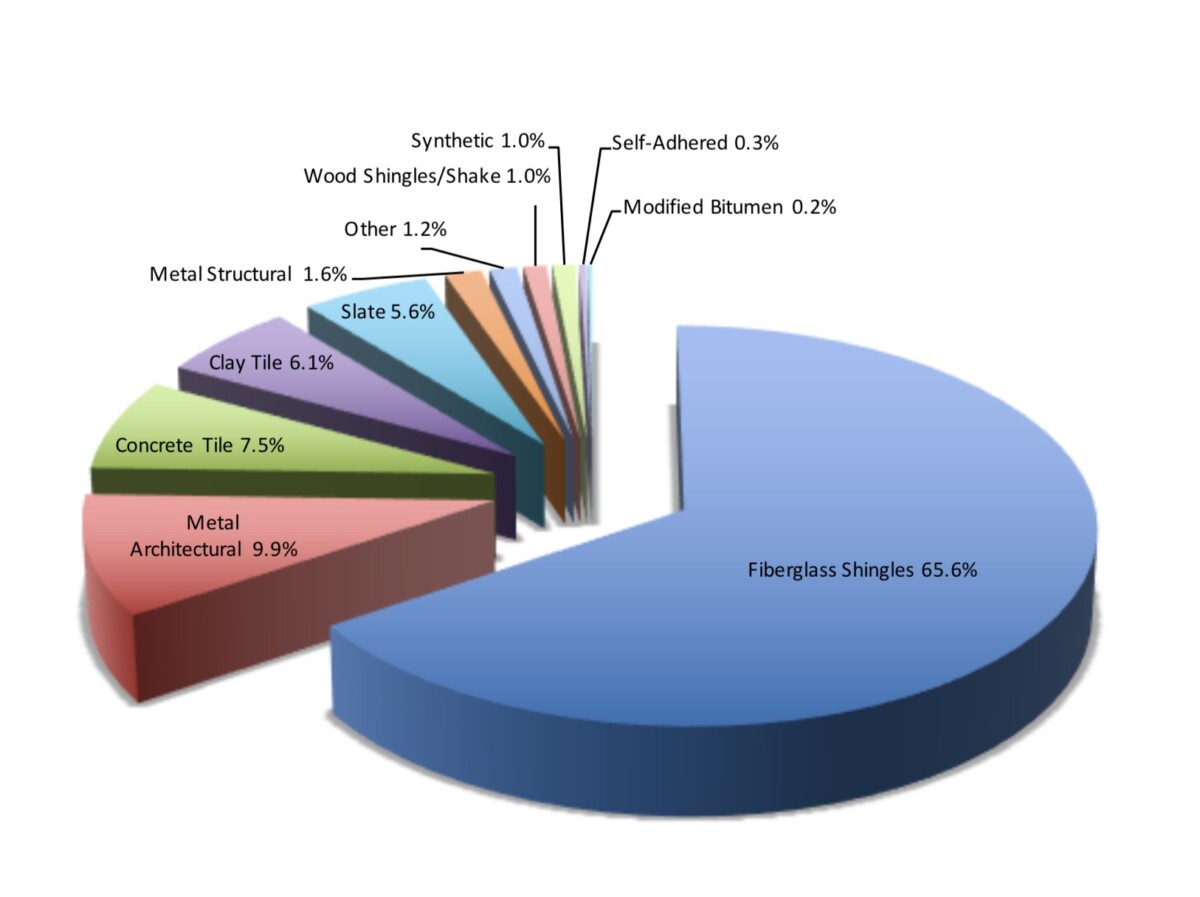

Residential Product Mix

Custom homes and upscale tract homes are again being built but at a slower rate. The high-end products, such as tile, slate, metal, and premium fiberglass shingles, are all doing well. The construction and sale of single-family homes and multi-family residences has also slowly been increasing. Some are moving to smaller upscale condos, either as a second home or as an office away from home.

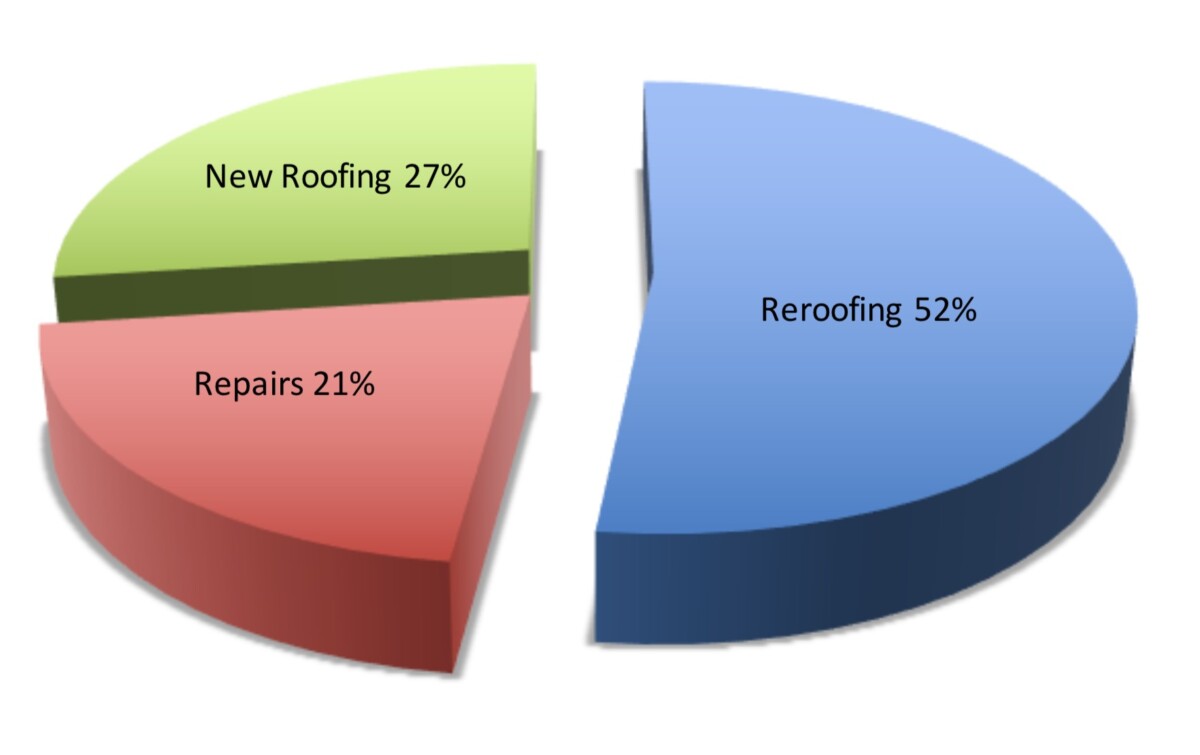

Reroofing & New Construction

Reroofing continues to dominate the Western steep-slope market, and always will. Reroofing will capture a predicted 52% of the total Western residential volume. This is about the same as last year. Repairs and maintenance will account for 21%, up slightly from the previous year. The remaining 27% goes to new construction.

Product Mix

Once again, the most popular steep-slope roofing product installed in the West is, was, and remains fiberglass shingles, with a lion’s share of 65.6% of the market. This market percentage for fiberglass shingles is up slightly from last year. Metal, concrete tile, clay tile, and slate remain approximately the same as last year.

Down the Road

Everyone is wondering just how long the Western residential market will continue to increase with talk of a recession on the horizon. There are many unknowns, including increasing mortgage rates and the worldwide economic climate. Then there’s the ever-present challenge to find enough warm bodies to work on the roof.

The construction industry is currently experiencing a slow but steady upswing in both low-slope and steep-slope construction projects. The majority of industry sources seem to agree that this trend will continue for the immediate future. Right now, most Western roofing contractors are busy and happy to once again get material when they need it. However, they’re trying to find enough workers to get back on the roof.